|

Roche Farm & Garden

Market Data

News

Ag Commentary

Weather

Resources

|

Is Axon Enterprise Stock Outperforming the Dow?/Axon%20Enterprise%20Inc%20logo%20with%20buy%20and%20sell-by%20NPS_87%20via%20Shutterstock.jpg)

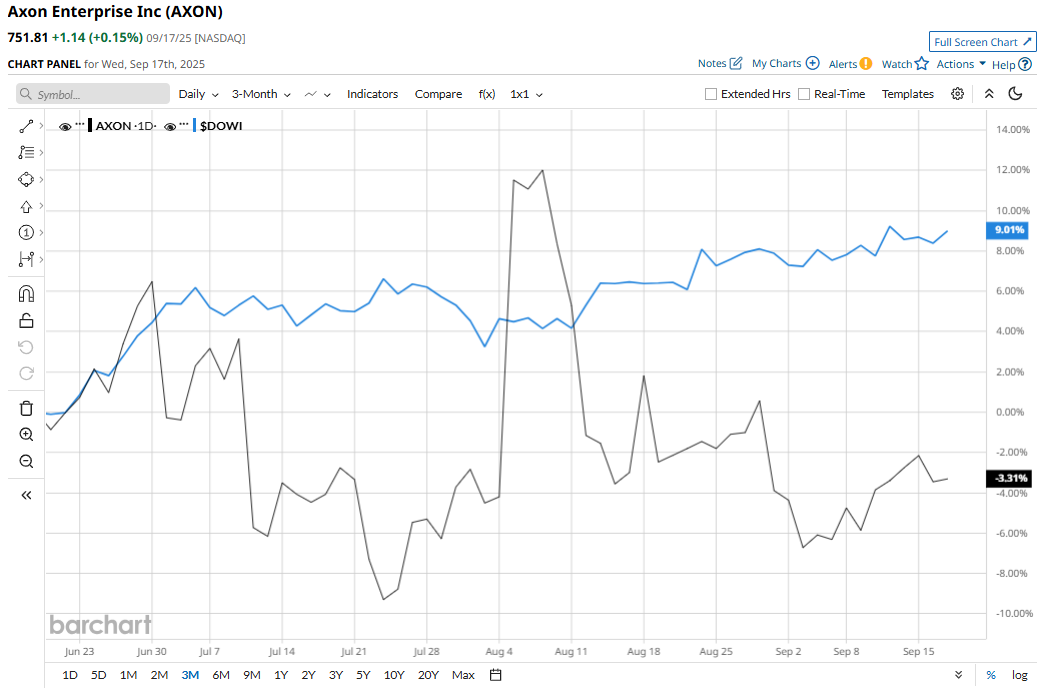

Axon Enterprise, Inc. (AXON) is a technology and public safety company that designs and manufactures hardware and software solutions for law enforcement, first responders, and civilians. Founded in 1993, Axon develops electroshock weapons under the TASER brand, body-worn cameras, cloud-based evidence management platforms, drones, digital reporting tools, and related services. The company is headquartered in Scottsdale, Arizona. Axon’s market cap is around $58.9 billion. Companies with a market cap of $10 billion or more are typically classified as “large-cap stocks,” a category that represents established businesses with significant financial strength and global influence. Axon Enterprise fits well into this category, underscoring its scale, stability, and competitive leadership. Axon has carved out a dominant position in law enforcement technology, and the company’s status highlights its entrenched leadership, broad adoption among public safety agencies, and the growth potential that comes from expanding its software and sensor ecosystem. However, AXON is currently trading 15.1% below its 52-week high of $885.91, reached on Aug. 5. Also, over the past three months, shares of Axon Enterprise have declined 3.3%, underperforming the Dow Jones Industrials Average’s ($DOWI) 9% gains during the same time frame.  Nevertheless, the stock demonstrated strength in the longer term. AXON has delivered 26.5% returns on a year-to-date (YTD) basis, outpacing DOWI’s 8.2% gains. Plus, the stock has surged 96.5% over the past 52 weeks, compared to Dow Jones’ 10.6% returns over the same period. AXON’s stock has cruised above its 200-day moving average all year, showing steady long-term strength. The 50-day line’s been shakier – mostly supportive, but since mid-August, AXON has slipped underneath, hinting momentum is cooling and traders are eyeing whether support holds or cracks.  Axon’s shares have slipped lately because of concerns about its high valuation, rising costs, and the fallout from ending its partnership with Flock Safety, which has turned what was a complementary relationship into a competitive one. Despite these headwinds, its underlying business continues to show strong growth momentum with accelerating demand for its software, services, and public-safety hardware lines, leading to steady long-term gains. Compared to its rival, Lockheed Martin Corporation (LMT), AXON has pulled ahead, as LMT slipped 16.6% over the past 52 weeks and 2.6% on a YTD basis, underscoring AXON’s stronger momentum. Analysts are not shy about their outlook on AXON stock. With a “Strong Buy” consensus from 18 analysts offering recommendations and the mean price target of $869.73, there is 15.7% upside potential from the last closing – signaling confidence that momentum still has room to run. On the date of publication, Sristi Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|